The Unintended Consequences of Financially Engineered Healthcare

All of us (and all our actions) are part of a large and complex network of relationships called community. New relationships and unique events continually change the world in which we live. This continual emergence of new and unique circumstance gives us the opportunity to rethink foundational beliefs about how society works and how we achieve desired change.

A recent example is the statistically significant increase in mortality among Medicare beneficiaries following the implementation of the Hospital Readmissions Reduction Program (HRRP). The program imposed financial penalties on hospitals based on rates of 30-day risk-standardized hospital readmission. The associated increase in mortality was documented in research reported by RK Wadhera et al. and further explained in an accompanying editorial by Gregg Fonarow, M.D., who criticized the program’s implementation in the absence of evidence-based safety guidance or necessary additional hospital resources.

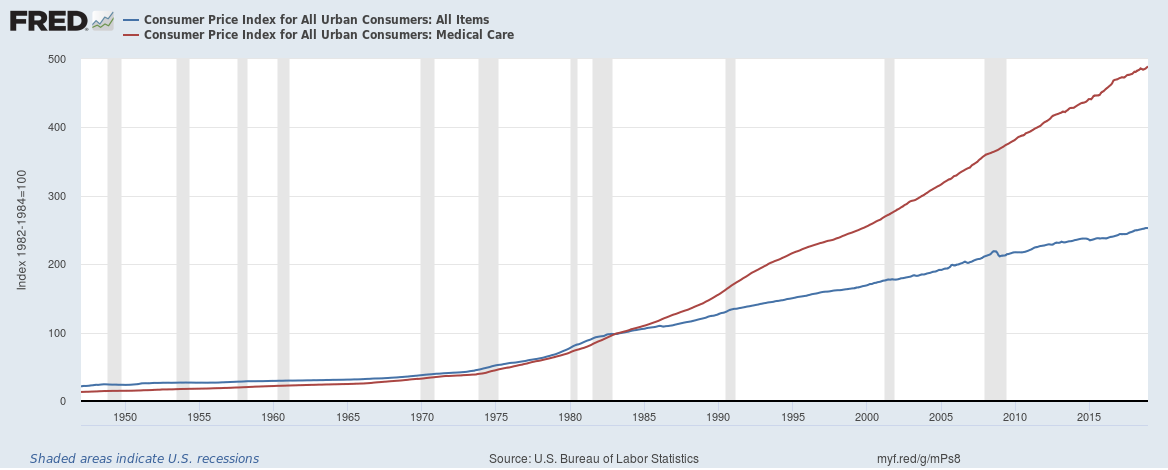

To those significant concerns, I would add the false belief that financial incentives are reliable tools to achieve desired outcomes in non-financial situations. Another example of this problematic financial engineering is managed care itself. In 1973, congress passed the HMO Act, envisioned as a remedy for healthcare cost. At that time, medical care consumed slightly more than 7.2% of GDP. Physicians were considered too empathetic and disorganized and blamed for waste and unnecessary care. Business-based management was expected to deliver manufacturing-type process efficiencies that would lead to economic efficiency and lower cost. Instead, what was implemented to control cost in fact made it worse, as shown in the comparison between the price indexes for all items (CPI) vs. medical care in Fig. 1.

Figure 1: Consumer Price Index all items vs medical care -- From St Louis Federal Reserve Bank

Managed care has created a more structured, integrated and evidence-based delivery system, but cost has not been controlled. Healthcare now consumes 17.9 percent of GDP, up 10.7 percentage points. The system models we use are not delivering what is needed.

Incentives are unreliable outside their native context or environment.

Healthcare and social services supply non-monetary services. Hospitals, physicians, social services, and behavioral health all have human values as their primary purpose. The importance of finance in this context is to make that mission possible.

The relationship of human value to monetary value is important and partly explains why financial incentives produce unintended consequences. The human value of a community service has implicit context (circumstance) and content (specific achievement). Money, on the other hand, is portable economic power stripped of both. It is hard to control what happens when finance is used to influence specific parts and process within large, complex initiatives. It is all too easy to inadvertently embed unaligned financial goals and misdirection.

In the hospital readmission program example above, the true goals were to ensure patients were healthy enough to go home before discharge, and that outpatient management would keep them healthy. This fits with the strategic end of healthy patients where achieving that end leads to less care and lower overall cost over time. What went wrong? Why didn’t these financial incentives lead to those outcomes?

Financial incentives intended to reduce a specific, often necessary intermediary steps or processes can create financial distractions unaligned with the core purpose. As a result, hospitals following the rules can unintentionally be rewarded for avoiding proper re-admission of patients who may need it, leading to more illness, cost and, as we’ve seen from the work of Wadhera, et al., occasionally death. The response is too often added bureaucracy - another source of error and cost.

A better answer is to separate the business model from the care model.

The care model exists to achieve purpose.

Avoiding financial incentives in the care model helps ensure focus on true purpose. Financial incentives are inherently non-specific, and combined with the complexity of the environment, become problematic. If we want to change the behavior of the care model, it is important to develop non-monetary incentives and rewards tied to purpose. In this way, the creation of the desired outcome occurs in a consistent environment aligned to the goal.

That is not to say that the business/financial side is bad; it is not. It is in fact critical, and for the same reason needs its own environment perfected to support what it needs to do.

Business models exist to monetize the care model.

If the output of the service from the care model produces a desired human value, it is monetizable. This is true for any of the social determinants of health. Moreover, the same outcome is likely to have multiple customers, and each customer may need its own business relationship and model. What emerges is a marketplace for outcomes.

We begin by recognizing that social determinants of health are really outcomes that serve broad-based community needs. For example, for managed Medicaid organizations, this patient-centered care model would be run by a community specialized provider network capable of outcome-driven, risk-based contracting focused on the 3% of patients driving 30% of cost.

Alternatively, a care model delivering community-based outcomes could be performance monetized using Outcome Based Units (OBU) achieved in specific high-need patients.

Last, organizations in the community could deliver results in the framework of neighborhood collective impact initiatives and specific pay-for-success programs. This would revolutionize our society’s approach to community needs, make better use of government and private agency grants and stabilize funding for critical community organizations.

Removing embedded financial incentives from the internal components of the care model allows healthcare (medical, behavioral and social) to refocus on its core purpose, and this alignment to purpose is the first of four principles necessary to improve community health. I will explore the other three – a multi-system problem needs a multi-system response; an adaptive problem needs an adaptive response, and; networks must learn and adapt to solve persistent problems - in future articles. These principles translated to smart adaptive community networks will create desired outcomes and sustainable finance.

References

Wadhera RK, Joynt Maddox KE, Wasfy JH, Haneuse S, Shen C, Yeh RW. Association of the Hospital Readmissions Reduction Program with Mortality Among Medicare Beneficiaries Hospitalized for Heart Failure, Acute Myocardial Infarction, and Pneumonia. JAMA. 2018;320(24):2542–2552. doi:10.1001/jama.2018.19232

Fonarow GC. Unintended Harm Associated with the Hospital Readmissions Reduction Program. JAMA.2018;320(24):2539–2541. doi:10.1001/jama.2018.19325

HMO Act of 1973, 42 U.S.C. § 300e